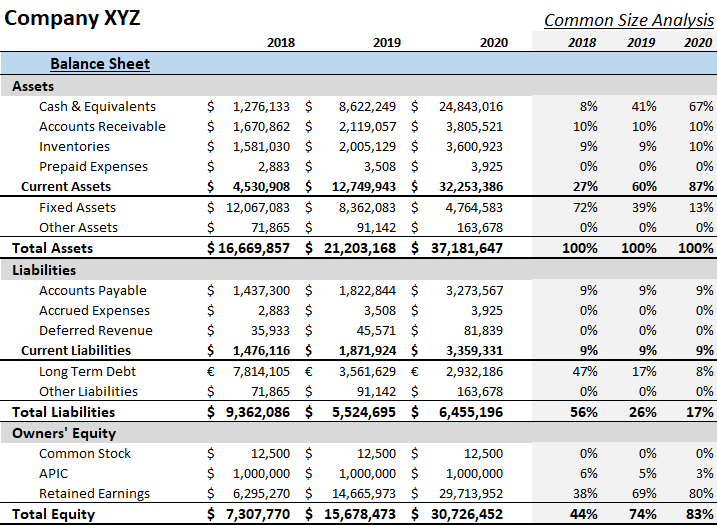

Common Size Balance Sheet Format - Each line item on the balance sheet is restated as a percentage of total assets. The balance sheet common size analysis mostly uses the total assets value as the base value. Web a common size balance sheet is a balance sheet that displays both the numeric value and relative percentage for total assets, total liabilities, and equity accounts. Web balance sheet common size analysis. A financial manager or investor can use the common size analysis to see how. Assets are expressed as a percentage of total assets, liabilities as a percentage of total. Web the common size balance sheet analyzes a balance sheet that presents each item as a percentage of a standard figure.

The balance sheet common size analysis mostly uses the total assets value as the base value. Assets are expressed as a percentage of total assets, liabilities as a percentage of total. Web a common size balance sheet is a balance sheet that displays both the numeric value and relative percentage for total assets, total liabilities, and equity accounts. Web the common size balance sheet analyzes a balance sheet that presents each item as a percentage of a standard figure. A financial manager or investor can use the common size analysis to see how. Web balance sheet common size analysis. Each line item on the balance sheet is restated as a percentage of total assets.